POC in Software Development: Meaning, Benefits, and How It Works

Explore what Proof of Concept (PoC) in software development is, how it benefits teams in making better decisions, and how it works.

Continue Reading

How is technology leveling up the finance industry in the U.S.?

Well, let us tell you that the shift in technology has been massive in the finance industry. From mobile banking and digital wallets to AI-powered investing, fintech has completely changed how people manage money.

In fact, fintech adoption in the U.S. hit 74% in Q1 2025, which depicts how fast users are also embracing this change.

Looking at this growth, many businesses are already exploring Fintech app development in the US. This is not just to stay competitive in the market but also to provide users with the type of transactions they expect nowadays, that is, everything from speed, security, to convenience.

If you are someone looking to enter the fintech market, understanding the fintech app development cost is very important for you. Knowing the average fintech app development cost in the US will help you plan your project wisely, and you will also be able to figure out what features, design, and complexity your app will have.

Explore the fintech app development cost in the U.S, the main factors that influence pricing, and what to expect when building a finance app in 2025.

Before diving deep into costs, let’s have a look at the market of fintech app development:

According to Mordor Intelligence, the global fintech market is expected to reach USD 652.80 billion by 2030, which suggests that the fintech industry is thriving. What is driving the growth of the fintech industry is the growing consumer demand for seamless digital finance experiences. Fintech is already making its mark by serving digital solutions for banking, lending, insurance, and wealth management, too.

There are so many services that are helping the fintech industry grow, including the integration of artificial intelligence and machine learning in financial decision-making, the expansion of Buy Now, Pay Later (BNPL) services, embedded finance, and increased regulatory support for open banking initiatives.

With the competition increasing, gaining a competitive edge through quicker go-to-market, data-driven personalization, and bulletproof security is becoming the focal point of numerous startups and incumbents, and all of them directly affect the time and money that are necessary to create an app.

So, what is the actual cost of building a fintech app in the US?

The cost of fintech app development has a wide range, as it depends on many factors, including the complexity of the app, the features included, the security requirements, and the development team you choose.

If we consider the average fintech app development cost, it would be around $100,000 to $500,000 or more.

If you choose to develop a simple app with basic features and hire an offshore team as your development partner, then the costs might be lower than if you decide to build an enterprise-grade fintech app with advanced features and hire an expert development partner.

As mentioned previously, the costs of building a fintech app significantly depend on its complexity, features, and other factors. Another major factor that decides the cost of a fintech app is the type of app you’re looking to build. This is because the type of app you choose to build would further guide you towards choosing its features, design, and other things. Each category of a fintech app has its requirements, like technical demands, compliance requirements, and user expectations.

Let’s have a look at the type of fintech app cost estimation:

| App Type | Estimated Cost (USD) |

| Mobile Banking App | $150,000 – $400,000 |

| Digital Wallet / Payments | $100,000 – $300,000 |

| Investment / Trading App | $200,000 – $500,000+ |

| Lending / BNPL App | $120,000 – $350,000 |

| InsurTech App | $100,000 – $250,000 |

| Cryptocurrency App | $150,000 – $450,000+ |

| Personal Finance / Budgeting | $80,000 – $200,000 |

Mobile banking apps are the type of fintech apps where you can manage your bank accounts, transfer funds, pay your bills, and even access other financial services. The cost of building this type of fintech app depends on its real-time integrations with the banking systems, its KYC/AML Compliance, its high security level, and multi-platform support. These are the basic requirements of building a mobile banking app, and each requirement adds to the cost.

Digital wallet and payment apps help users transfer money to others, make merchant payments, and even conduct QR code transactions. These types of apps are built with payment gateway integrations, security layers, scalability, and regional compliance support like PCI-DSS. These are all the basic features that are essential for these apps.

These types of fintech apps provide stock, crypto, or EFT trading options, often with advanced analytics and real-time market data. Investment and trading apps are typically expensive to build because of complex features like AI-driven insights or real-time order execution.

The lending and BNPL apps allow people to access microloans, P2P lending, or buy-now-pay-later services. The factors that influence the cost of these types of finance apps are credit scoring algorithms, identity verification, payment scheduling, and secure data handling.

These types of fintech apps can be used for buying, managing, and renewing insurance policies. The features that are required for this app and which add to the cost of building these apps are complex user workflows, pricing engines, document uploads, and policy comparison features.

Cryptocurrency apps, or we can also say trading apps, require features like deep encryption, real-time price feeds, blockchain integration, and custody solutions, which make them both high-cost and high-risk; hence, the cost of building this type of fintech app is high.

Personal finance or budgeting apps are typically less expensive to build as they are focused on simpler features like expense tracking, savings goals, and financial planning. These apps can later grow and demand complex features in the future, like AI integration or open banking integration, because of the growing demand.

Each Fintech app type serves a distinct user need and comes with unique technical requirements. Understanding the core function of your app and its expected scale can help you more accurately estimate development costs and prioritize features.

Starting with a focused MVP based on the app type is a common way to control initial costs while allowing for future scalability.

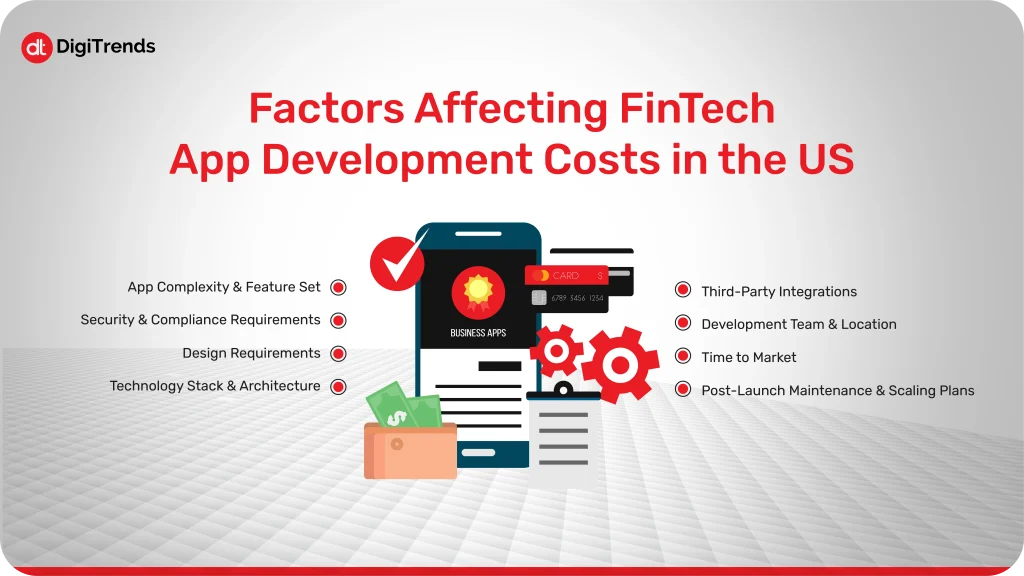

While the type of fintech app defines the general cost range, several key factors ultimately determine where your project will fall within that spectrum. From compliance complexity to development team choices, understanding these variables will help you plan your budget more accurately and avoid unexpected expenses.

Let’s have a look at the factors affecting fintech app development cost:

The more features you want, the more development hours you’ll need. A simple budgeting app may require only basic data tracking and user authentication, while a full-fledged banking app might include transaction management, biometric security, and AI-based financial insights. Each added feature, especially those involving real-time data or third-party integrations, raises the total cost.

Fintech apps deal with highly sensitive user data and are subject to strict regulations like GDPR, PCI-DSS, KYC, AML, and PSD2. Meeting these standards requires extra layers of encryption, legal vetting, audit trails, and secure coding practices, all of which add to the cost.

In Fintech, user trust is built through a clean, intuitive design. Apps often require high-quality UI/UX, responsive layouts, and interactive dashboards. Custom design elements, user flow optimization, and prototyping tools contribute to both upfront and ongoing costs.

Choosing the right tech stack affects scalability, performance, and long-term maintenance. Real-time data streaming, blockchain infrastructure, AI integrations, or cloud-native builds require specialized tools and talent, raising development complexity and costs.

Integrations with banks, credit bureaus, payment gateways, or analytics platforms are essential in most Fintech apps. Each integration involves licensing, API management, and security validations, which can substantially increase costs, especially when working across borders.

Costs vary widely based on whether you hire an in-house team, outsource to an agency, or work with freelancers. Geography plays a big role too; developers in North America or Western Europe charge significantly more than those in South Asia or Eastern Europe, without necessarily sacrificing quality.

If you need to launch quickly, you might need to scale your team, speed up design and testing, or adopt low-code tools, all of which impact budget. Accelerated timelines usually mean higher costs due to the need for more resources in a shorter span.

Your costs don’t end at launch. Ongoing updates, feature enhancements, bug fixes, and infrastructure scaling (especially if your user base grows rapidly) are essential and should be factored in as a percentage of your initial development budget, typically 15–25% annually.

Fintech app development isn’t one-size-fits-all. Your app’s cost is shaped not just by what you build, but how, where, and why you build it. By identifying the factors that most influence your specific goals, whether it’s airtight compliance, rapid launch, or cutting-edge features, you can better allocate your budget and make smarter decisions throughout the development journey.

Bringing your Fintech app idea to life requires more than just a great concept; it takes careful planning, compliance awareness, and a methodical approach to development.

Let’s have a look at the step-by-step roadmap to help you navigate the process and set your project up for success:

Start by identifying who your app is for and what specific financial problem it solves. Is your target market underserved consumers, small businesses, crypto traders, or another segment? A deep understanding of your audience’s pain points and needs will guide your features, design, and compliance priorities.

Conduct competitive analysis to see how similar apps perform and what gaps you can fill. At the same time, familiarize yourself with the financial regulations and data privacy laws that apply in your target markets, such as GDPR, PCI-DSS, PSD2, KYC/AML, or local open banking rules. Compliance should be factored into your app from the ground up.

Instead of building every feature at once, focus on an MVP that delivers your app’s core value efficiently. Identify must-have functionalities for launch, such as secure login, basic transactions, or account linking, and save advanced features like AI-based insights or multi-currency support for later updates.

Decide whether you’ll build in-house, outsource to a development agency, hire freelancers, or take a hybrid approach. Consider your budget, timeline, and need for specialized fintech expertise when choosing a team. Whichever route you take, make sure your developers understand financial-grade security and compliance standards.

With your MVP features and development approach defined, set a realistic budget and timeline. Build in a buffer for unforeseen expenses and allow adequate time for testing and regulatory reviews. Remember to allocate funds for post-launch maintenance and scalability.

Work with your team to design intuitive user flows and wireframes that match your users’ expectations. Draft a detailed Product Requirements Document (PRD) that outlines all features, user stories, integrations, and compliance considerations. This helps keep development aligned with your vision.

Use an agile methodology to build and test your app in stages, getting feedback at each milestone. Pay special attention to security testing, performance under load, and regulatory compliance checks. User acceptance testing (UAT) before launch ensures the app meets real-world needs.

Roll out your app to the market, often starting with a limited beta to iron out any remaining issues. Monitor usage metrics, gather user feedback, and prepare for regular updates to keep your app secure, competitive, and aligned with evolving regulations.

When estimating the fintech app development cost in the U.S., most people think only about design, coding, and testing. But here’s the thing: the real cost often goes beyond what’s on the initial quote. Understanding these hidden expenses can help you plan a realistic budget and avoid unpleasant surprises later.

Fintech apps deal with sensitive financial data, which means strict U.S. regulations like PCI DSS, KYC, AML, and GDPR compliance. Getting certified or integrating tools to meet these standards often adds unexpected costs, especially during the final testing stages.

Security isn’t just a one-time setup. Encryption, fraud detection, and identity verification tools require ongoing updates and monitoring. These are essential for building user trust, but they can increase the overall average fintech app cost significantly.

Most financial apps connect with APIs for payments, analytics, or credit checks. While they save time, many of these services charge per API call or subscription fee, which can quickly add up once your user base grows.

After launch, your app will need regular updates for performance, bug fixes, and OS compatibility. Maintenance can take up 15–25% of the original fintech app development cost annually, depending on complexity.

Cloud hosting, server scaling, and database management are ongoing costs. As your app handles more users and transactions, infrastructure expenses rise, especially if you prioritize fast load times and high uptime.

If your fintech app targets businesses or involves complex financial tools, you’ll likely need a dedicated support team or onboarding materials. It’s easy to overlook, but these human and operational costs play a big role in long-term success.

In short, the fintech app development cost in the U.S. isn’t just about coding; it’s about building a secure, compliant, and scalable product that can grow with user demand. Knowing these hidden costs upfront helps you set realistic expectations and invest smarter.

Building a fintech app is a significant investment, but with smart planning and the right approach, you can maximize every penny without compromising quality, security, or user experience.

Let’s have a look at the strategies to optimize your development budget:

Instead of building a fully-featured app from day one, define an MVP that delivers your core value proposition. This helps you validate your idea with real users, gather feedback, and minimize upfront costs. You can always add advanced features and integrations in future iterations once you achieve product-market fit.

Hiring the cheapest team can cost you more in the long run if they lack experience with fintech-specific challenges, such as compliance or secure architectures. Look for a development partner with proven fintech expertise, a transparent pricing model, and a track record of delivering scalable, secure apps. Offshore or nearshore teams can offer cost advantages, but they prioritize quality and reliability above all else.

Building every feature from scratch is rarely necessary. Instead, integrate with trusted third-party APIs and platforms for payment processing, identity verification, KYC/AML, and analytics. These ready-made solutions are often more cost-effective and faster to implement while ensuring regulatory compliance and reliability.

Rushed or vague planning often leads to costly rework later. Invest time in clearly defining:

Even if you’re starting small, design your app’s backend to handle growth efficiently. Choosing a cloud-native, modular architecture ensures your app can scale as your user base and transaction volumes grow, saving you from costly infrastructure overhauls later.

A faster launch often means higher costs due to more resources and accelerated work. On the other hand, dragging the timeline can rack up unnecessary overhead. Work with your development team to find a timeline that balances your go-to-market goals with budget efficiency.

Post-launch maintenance, including bug fixes, security patches, feature updates, and scaling, typically costs 15–25% of the initial development budget per year. Allocating this in advance avoids financial strain and ensures your app remains competitive and compliant over time.

By applying these strategies, you can better control costs while delivering a secure, high-quality fintech app that meets user expectations and regulatory demands. Strategic budget optimization not only reduces risks but also positions your app for long-term success in the fast-evolving financial services market.

The success of any Fintech app hinges on the features it offers, balancing functionality, security, and user experience. While the specific features may vary depending on the type of fintech solution (e.g., mobile banking, budgeting, trading), the following core functionalities are essential for most modern Fintech applications:

A smooth onboarding process with options like email, phone, biometrics, or social logins is vital. Security is non-negotiable; implement multi-factor authentication (MFA), biometric verification, and session timeout for enhanced safety.

A personalized dashboard gives users an overview of their financial data, recent transactions, account balances, investments, or credit scores, depending on the app’s focus. Clean design and clarity are key here.

Allow users to connect their bank accounts, e-wallets, or payment platforms (like PayPal, Apple Pay, etc.). This enables seamless fund transfers, payments, and financial tracking.

Include features for sending and receiving money, scheduling payments, viewing transaction history, and managing beneficiaries. Add support for QR code payments and peer-to-peer (P2P) transfers where applicable.

Push notifications for transactions, account changes, suspicious activity, or reminders help keep users informed and engaged. Customizable alerts add to user control.

Built-in encryption, secure APIs, GDPR-compliant data handling, and compliance with financial regulations (like KYC, AML, PCI-DSS) are essential to protect user data and meet legal requirements.

Provide AI-driven insights, spending analysis, savings suggestions, or credit monitoring. These value-added tools increase user engagement and help position your app as a financial assistant.

Offer in-app support options like chatbots, live support, FAQs, or ticketing systems. Fast and helpful support enhances trust, especially in apps dealing with sensitive financial matters.

A robust backend for admins to manage users, monitor transactions, flag suspicious activity, and view analytics. It’s the control center for app operations and compliance oversight.

Including the right combination of features tailored to your users’ needs is crucial. Prioritizing core functionality, user experience, and regulatory compliance from the start helps ensure your app is secure, scalable, and ready to meet market demands.

Building a fintech app offers immense potential, but it also comes with a unique set of challenges. From tight regulations to fast-changing technology, developers and founders need to navigate several obstacles to bring a secure, reliable product to market.

Let’s have a look at some key challenges you should be prepared for:

Fintech is one of the most heavily regulated industries. Ensuring compliance with global and local regulations like GDPR, PSD2, PCI-DSS, KYC, and AML can be complex and time-consuming. Any misstep can lead to legal penalties or loss of user trust.

Handling sensitive financial and personal data makes security a top priority. Implementing robust encryption, secure APIs, and authentication mechanisms while guarding against threats like fraud, data breaches, and identity theft is a constant challenge.

Users are often cautious when it comes to sharing financial data. Building a trustworthy app requires a transparent privacy policy, intuitive UI, reliable support, and proven security practices from day one.

Fintech apps often need to integrate with banks, payment gateways, credit bureaus, or financial institutions, many of which rely on outdated or fragmented systems. Ensuring seamless, real-time data exchange without compromising speed or security can be difficult.

Fintech moves fast; what’s cutting-edge today might be outdated tomorrow. Keeping up with evolving technologies like blockchain, AI, open banking APIs, or embedded finance requires ongoing adaptation and a future-proof development strategy.

As user bases grow, so does the demand on backend systems. Poor architecture can lead to latency, downtime, or transactional errors. Building for scalability from the start helps avoid performance issues during peak loads.

Delivering a consistent and responsive experience across iOS, Android, and web platforms, while maintaining security and performance standards, can be challenging, especially when features like biometric logins or native APIs are involved.

Building a fintech app is more than just writing code; it’s about creating a secure, intuitive, and compliant product that users can trust. That’s where DigiTrends comes in.

Our team has hands-on experience delivering fintech app development solutions in the U.S., helping startups and enterprises turn complex financial ideas into powerful digital products. From mobile banking and investment apps to digital wallets and payment platforms, we handle every stage, strategy, design, development, testing, and post-launch support.

We understand that the fintech app development cost isn’t just about the build; it’s about long-term scalability and compliance. DigiTrends ensures your app meets U.S. financial regulations, integrates seamlessly with APIs, and stays ahead of security threats.

Whether you’re looking to launch an MVP or scale an existing platform, our approach is simple: combine deep financial insight with innovative tech to help your product stand out in a crowded market.

In short, DigiTrends helps you save time, reduce risk, and get a fintech app that’s built to grow, not just function.

The fintech industry in the U.S. isn’t slowing down anytime soon. With digital banking, crypto platforms, and payment apps reshaping how people manage money, the demand for reliable, secure, and user-friendly fintech solutions keeps growing.

Understanding the fintech app development cost in the U.S. is key to building a successful product. The price can vary based on features, security, compliance, and maintenance, but smart planning and the right tech partner can help you manage those costs efficiently.