Why Multimodal AI Matters: How It Works and Where It’s Being Used

Explore more about multimodal AI applications in different industry sectors, their benefits, real-world applications and more.

Continue Reading

If you are someone who wants to actually see the work that generative AI is doing when you enter a bank or use a banking application, then you might not see it, but you must have once experienced the work it does from the back of the systems and applications.

Wondering how you must have experienced it from the back of the systems and applications?

Well, in this context, the back of the systems and applications could be anything, such as being able to make quicker loan decisions, getting faster chat support, or quick alerts for any unusual activity detected. These are all examples of generative AI that you have probably experienced so many times by now, since it has become a part of the financial world.

Banks have now moved into the stage where Gen AI is no longer just a cool experiment; it is now being properly used in systems and workflows. Some examples of generative AI in banking are writing emails, summarizing regulations, and creating credit memos. This is how the use of AI in banking is subtly becoming a common practice.

If you are a financial institution that wants to know what benefits generative AI can provide you, it can help you have a better understanding of your customers and reduce the number of bottlenecks you face as a bank.

There is no doubt in the fact that with every new technology comes its own set of challenges and limitations, such as data quality issues, ethical issues, or the conflict between innovation and compliance. Similarly, the script of generative AI is also not only about making systems and processes smarter.

Let’s explore the real use of generative AI in banking, where banks are already seeing impact, and the challenges they need to navigate to make this shift sustainable. In this guide, you can have a clear understanding of how you can use generative AI in the banking industry and what you will need to make all the right decisions while doing it. No hype, no jargon, just a clear view.

When you think about generative AI in banking, the first thing that might come to your mind is chatbots answering queries or automated systems that quickly flag unusual transactions, but let us tell you that’s just scratching the surface when it comes to the power Gen AI holds in banking.

The thing about generative AI is that it will not only follow the rules set by you, but also help with tasks like creating reports, summaries, and drafting documents for analysts, and we all know how long a process this is if it’s done manually, right?

So, is the use of AI in baking new?

Well, the use of AI in banking isn’t new at all. But we can surely say that generative AI has added one more layer to this technology, and this layer is more intelligent and more human. It holds the potential to process massive amounts of data and produce results and outputs within seconds that are valuable for the banks. Whether it is crafting customer communication or simulating financial scenarios, it can do it all.

Think about how much banks spend while generating risk reports, or when they have to prepare personalized investment advice. Gen AI can cut all the manual work by taking raw data and turning it into insights on which the concerned party can take immediate action.

This not only improves efficiency, but it also completely transforms the way banks operate. For example, an investment analyst can easily focus on decision-making instead of going through large amounts of data and sorting it out to reach a decision. Similarly, loan officers can focus on responding to applications faster, and customer service teams can improve their guidance.

To explain it simply, we can say that Gen AI in banking is not just about making the systems smarter, it is also about giving the customers better support so they can easily and confidently. You, as a bank, can keep your customers loyal through this new tool, as more and more banks are adopting this technology, you need to make sure to provide your customers with the best, so you don’t lose them to other competitors.

Thinking about the catch in this?

Well, deploying generative AI in a highly regulated environment like fintech is not straightforward. Banks are required to ensure compliance with all the necessary regulations, data privacy, and navigate operational challenges that they face while figuring out how to implement AI into their workflows.

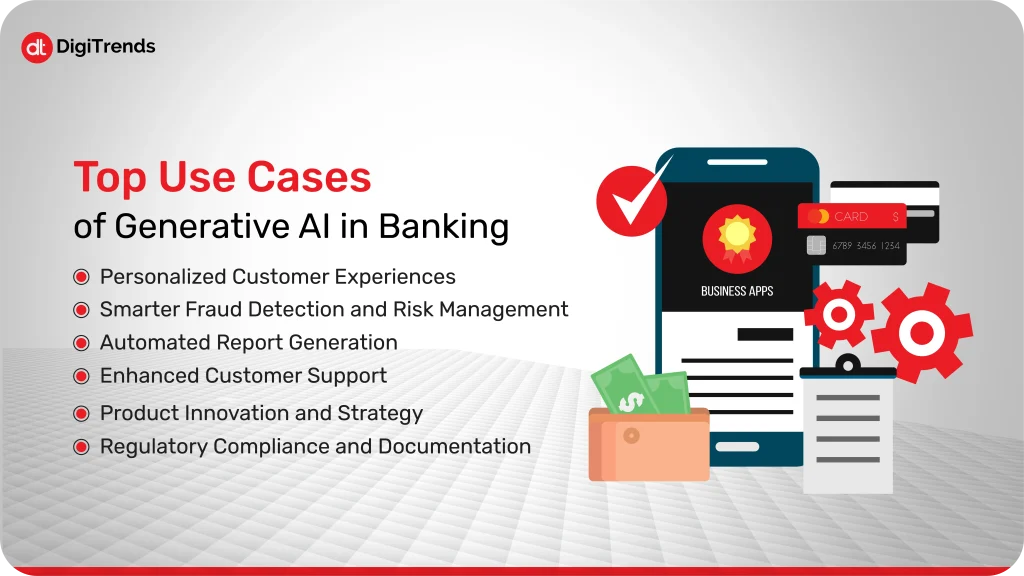

Many banks are already experimenting with generative AI in different ways, which can touch almost every part of their operations. Let’s have a look at the uses of AI in banking:

Nowadays, customer expectations have increased regarding their usage and experience. Gen AI delivers exactly what customers need; it analyzes transactions, histories, spending patterns, and even social data that helps it craft personalized recommendations. AI is truly making a positive difference in customer experiences by providing services like suggesting the right credit card, forecasting cash flow, and offering investment advice.

With all these services, banks can engage with clients in a better way and provide them with timely information.

There is no doubt in the fact that fraud is very common nowadays, especially in the fintech industry. Scammers are always waiting for a chance to get a gateway to enter the systems. It’s not like traditional systems can’t detect suspicious activities, but they flag these activities based on fixed rules, which sometimes can be slow, or these systems may also miss subtle patterns of the scammers. But that’s not the case with generative AI; it can easily handle a large amount of datasets, predict any unusual activity, and also send out alerts in real time when required.

The difference is that Gen AI doesn’t just react; it anticipates risk scenarios, which gives banks a heads up before the problem even shows up, so they can deal with it earlier.

If you are from the fintech industry, you must know how much importance financial reporting holds for banks and how time-consuming it can be. Gen AI in banking can help reduce this time by generating summaries of market trends, portfolio performance, and compliance reports.

This allows analysts to focus on more important parts of their jobs, like interpreting insights, rather than giving a lot of their time to going through a ton of documents and analyzing them. This also helps in speeding up the decision-making process across all departments.

Chatbots are not a new concept in banking, but generative AI in banking has taken it to a higher level. Customers do not receive scripted answers because the AI-driven assistants handle complex queries and respond according to the context; they can even learn from previous interactions to provide better responses.

This helps banks in making their customer support services faster, more accurate, and more human-like, too. If banks use generative AI for customer support, they can also gain a competitive advantage by reducing the risks of losing their customers to others.

Gen AI can be helpful for banks in predicting potential outcomes for new products or pricing strategies. It generates forecasts, scenario analyses, and market insights that support banks in strategic planning.

With the help of these insights, banks can go for innovation with confidence.

We all know that one of the hardest parts of the financial industry is compliance because it is non-negotiable; every bank or financial institution has to comply with all the regulations, or else there are serious consequences.

Generative AI in banking can be really helpful in this scenario by summarizing regulatory changes, drafting compliance documents, and even reviewing contracts for inconsistencies. This reduces the burden on legal and compliance teams as they no longer have to do everything manually.

What’s more interesting about the uses of AI in banking is that they are not isolated. Most of the banks are combining multiple AI applications to create an ecosystem where every system is smarter and more connected, from customer service to risk management.

We have previously only talked about what generative AI in banking can do. But you must now be curious to know how it’s actually being put to work in financial institutions all across the world. Let’s have a look at how global institutions and fast-moving digital banks are testing, deploying, and refining the use cases of Gen AI:

JPMorgan is one of the firms that has been experimenting with AI for years, but Gen AI has pushed things forward for them. Their teams now use Gen AI for tasks such as drafting their internal documents, summarizing research, and supporting fraud analytics. This way, analysts save the time that previously went into going through lengthy reports; they can now simply use AI for drafting and spend their valuable time interpreting insights.

HSBC is a financial institution that uses AI for its customer conversations. They use AI to reply to their customers faster and more accurately by providing customers with AI-assistants that guide them in real-time. They are also exploring new Gen AI tools to create regulatory summaries, which is something that takes weeks to prepare.

Bank of America’s virtual assistant has already very efficiently handled millions of customer interactions, but the new Gen AI features are now helping in generating personalized financial guidance, too, and no, it is not just answering simple questions, but it actually understands the context and then accurately responds, resulting in customers making smarter decisions.

Standard Chartered is one of the financial institutions that uses AI to simplify the processes. Their risk teams use AI-generated summaries to accelerate credit assessments. Compliance teams use it to scan large volumes of regulatory text and extract what’s relevant instead of reading everything manually.

Digital banks are operated differently from traditional banks because they adopt the new tools faster, as they have no barriers to going along with the legacy systems. Many of the digital banks now use Gen AI to support their customer onboarding, detect any abnormal spending patterns, generate content for customer communication, and even automate internal documentation. Their ability to adapt to new tools and technology is what helps them gain a competitive advantage, and this is only possible because they are not burdened with already established systems or complicated infrastructures.

Here’s what this really shows. Banks aren’t using generative AI in one single part of the business. They’re experimenting across workflows, improving everything from customer interaction to backend analysis. Some of these applications are still early-stage, but they reveal a clear direction: Gen AI is slowly becoming a standard tool in the banking industry.

Let’s break down why generative AI in banking is gaining momentum so quickly. It isn’t just about adopting new tech for the sake of looking innovative. The real value comes from what Gen AI changes behind the scenes and how it reshapes day-to-day work.

Banks deal with huge volumes of data, and most decisions depend on someone manually reviewing that information. Gen AI speeds this up. It can analyze documents, summarize insights, and surface patterns almost instantly. That means quicker loan decisions, smoother customer onboarding, and faster internal approvals. The result is simple: banks move with more confidence and far less friction.

People expect banking to feel personal. Generative AI helps banks understand customer behavior at a deeper level. It can look at spending habits, income flows, and past interactions to predict what someone might need next. This leads to more tailored offers, more relevant advice, and interactions that feel less like automated responses and more like real conversations.

Many tasks inside a bank are repetitive: drafting credit memos, summarizing market reports, preparing compliance documents, answering routine queries. Gen AI can take over the first draft of much of this work. It means teams aren’t buried under documentation. They can spend their time validating, refining, and making actual decisions instead of preparing content from scratch.

Fraud doesn’t follow predictable patterns anymore. It evolves constantly. Generative AI enhances existing risk models by learning from raw data and generating insights on suspicious behavior before it escalates. It can simulate risk scenarios, model potential outcomes, and flag unusual customer activity early. This gives banks a more proactive approach to risk.

Once integrated correctly, Gen AI reduces the need for manual effort across multiple workflows. Customer support becomes lighter, documentation gets done faster, and compliance reviews take fewer hours. Even small savings in time, when multiplied across teams and branches, add up to significant cost efficiency.

This is the part many banks underestimate. When one bank uses generative AI to deliver replies in seconds, update documents instantly, and provide meaningful insights on demand, customers notice. Efficiency isn’t just an internal win; it becomes a market advantage. Banks that embrace AI now end up shaping customer expectations for everyone else.

What this all means is that generative AI supports both the customer-facing and operational sides of the business. It improves the quality of decisions, speeds up processes, and makes banking feel more intuitive for customers and teams alike.

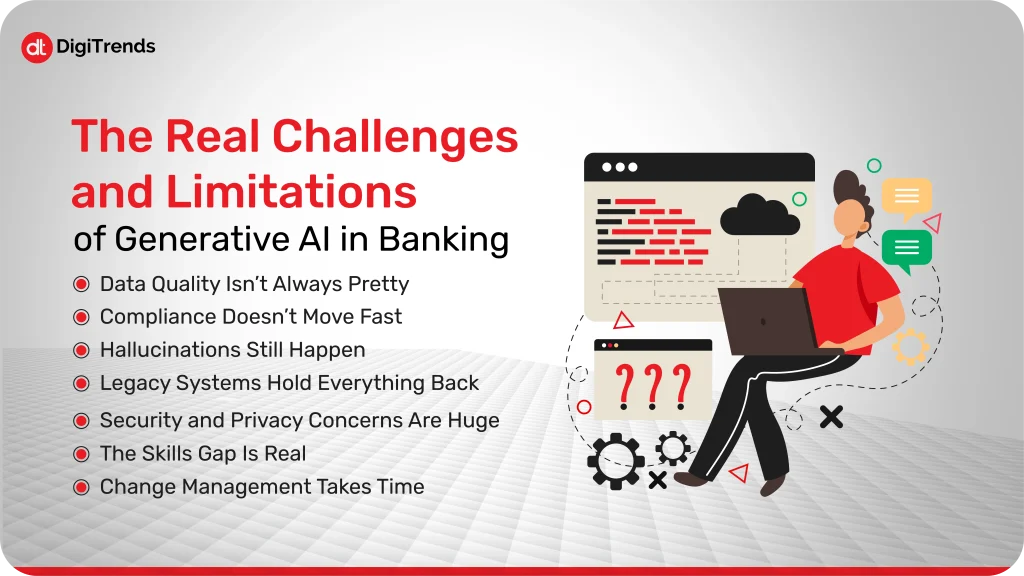

For all the excitement around Gen AI, the banking industry faces a very real set of hurdles. Some are technical. Some are cultural. And some are simply the reality of working in one of the most heavily regulated industries in the world. Here’s where things get complicated.

Banks store decades of information, but that doesn’t mean it’s clean, consistent, or easy to use. Gen AI performs only as well as the data it’s trained on. If the data is outdated, incomplete, or siloed, the output becomes unreliable. Before AI can shine, banks often have to fix the foundation, and that takes time.

The banking industry is heavily guarded by rules that evolve slowly. Generative AI moves fast. That creates tension. Every output AI generates must be reviewed for accuracy, bias, and regulatory alignment. Banks can’t afford even a small error in a compliance report or customer communication. This slows down adoption and adds extra layers of governance.

Gen AI can sometimes generate information that sounds confident but isn’t true. In everyday contexts, that’s manageable. In banking, it’s risky. A fabricated number in a credit memo or a made-up regulation in a summary can trigger serious problems. Banks have to build strict review systems so AI becomes an assistant, not an unchecked authority.

Many banks still rely on old infrastructure. Integrating generative AI into systems built years ago isn’t smooth. It leads to compatibility issues, slow processing, and data access limitations. Some banks end up spending more time fixing back-end systems than deploying the actual AI.

Banks handle sensitive information. That means any AI tool must follow strict rules on encryption, data storage, and access control. Even a small vulnerability can expose customer data. Banks must ensure that internal teams and vendors follow the highest security standards, which complicates experimentation and slows deployment.

Most banks don’t have teams deeply trained in AI, prompt engineering, model monitoring, or AI risk management. Banks also need employees who understand both banking rules and AI behavior, a combination that’s still rare in the job market.

Even the best AI tools fail if teams don’t adopt them. People are used to old processes. Analysts, branch teams, and compliance officers need training, guidance, and reassurance to trust AI-generated drafts and insights. Culture changes more slowly than technology, and that slows down real transformation.

Here’s the bottom line: generative AI in the banking industry isn’t a plug-and-play magic solution. The potential is massive, but banks have to navigate regulatory caution, operational rewiring, and new skill requirements to unlock that value safely.

Deploying generative AI isn’t about buying a tool and flipping a switch. It’s a careful process that balances innovation, risk, and customer trust. Here’s how banks can approach it effectively:

Before any AI project, banks should define what success looks like. Is it faster loan processing, better customer support, or smarter risk assessment? Clear goals ensure AI initiatives don’t become experiments without impact.

Data quality drives AI performance. Banks need to evaluate their datasets, remove inconsistencies, and unify siloed sources. The cleaner the data, the more accurate and reliable the AI outputs will be.

Instead of a full-scale rollout, start with a single workflow or department. Pilot projects allow teams to test AI capabilities, identify pitfalls, and refine prompts. Successful pilots create confidence and a roadmap for broader adoption.

Generative AI should assist, not replace, humans. For critical tasks like compliance checks or credit assessments, AI outputs should be reviewed and validated. This combination of human judgment and AI efficiency reduces errors and builds trust.

AI tools must meet the bank’s data privacy, security, and regulatory standards. This includes encrypted data handling, access controls, and audit trails for AI-generated outputs. Security isn’t optional; it’s part of the foundation.

Banks need teams that understand both AI technology and banking operations. This may involve hiring, training existing staff, or working with specialized partners. Internal expertise ensures AI tools are used effectively and responsibly.

Generative AI models aren’t set-and-forget. They need continuous monitoring to track accuracy, reduce bias, and adapt to changing business conditions. Regular evaluation allows banks to improve outputs and keep pace with evolving challenges.

Finally, adoption depends on people. Teams must see AI as a tool that makes their work easier and more impactful. Clear communication, training, and small wins help build a culture where AI becomes a trusted collaborator rather than a threat.

When implemented thoughtfully, generative AI transforms workflows instead of disrupting them. It becomes a tool that enhances human capability, reduces operational friction, and creates better experiences for customers and employees alike.

Navigating the world of generative AI in banking can feel overwhelming, especially when it comes to development and integration. DigiTrends specializes in designing and developing AI-powered solutions that align with a bank’s specific workflows and objectives. From creating intelligent customer-facing applications to automating internal workflows and systems, we focus on building tools that deliver real impact without disrupting existing operations.

Beyond development, DigiTrends supports banks in scaling their AI initiatives safely and effectively. By combining technical expertise with a clear understanding of regulatory and operational requirements, we ensure AI solutions are reliable, secure, and adaptable. The goal is simple: help banks leverage generative AI to enhance efficiency, improve decision-making, and provide a better experience for both employees and customers.

Generative AI in banking isn’t just a futuristic idea; it’s actively reshaping how banks operate, serve customers, and manage risk. From personalized customer interactions to automated reporting and smarter fraud detection, the possibilities are wide-ranging. Banks that embrace these tools can achieve faster decision-making, improved efficiency, and stronger competitive positioning, while those that hesitate risk falling behind in an increasingly digital landscape.

At the same time, the journey isn’t without challenges. Data quality, compliance, security, and the skills gap all require careful planning and oversight. With the right strategy, thoughtful implementation, and expert support, banks can navigate these hurdles and unlock the true potential of generative AI. The key is to treat AI as a partner, enhancing human capability rather than replacing it, and building systems that are both innovative and responsible.