DigiTrends Named Among the Financial App Development Companies for 2026 by Techreviewer.co

DigiTrends has been officially recognized by Techreviewer.co as one of the Top Financial App Development Companies for 2025.

Continue Reading

The core foundations of the financial industry are no doubt trust, accuracy, and transparency.

But still, for decades, this industry has depended on slow and expensive systems that are prone to human error and manipulation.

In this sector, every transaction requires verification through banks or middlemen, which requires more time for the process and also increases the cost.

So, what is the better alternative?

Blockchain technology offers a powerful alternative. It helps with faster, safer, and easier-to-trace transactions, while also eliminating unnecessary intermediaries.

From cross-border payments to identity management and lending, blockchain is redefining the foundation of financial systems worldwide.

Explore what blockchain really is, how it’s transforming finance, and what opportunities and challenges come with it.

Before we dive into the benefits and challenges of blockchain in finance, it is important to understand what it is all about and how it works.

Blockchain is basically a decentralized digital ledger. It helps in recording transactions across multiple computers in a network, which makes it almost impossible to alter or hack. Each “block” contains transaction data, and each new block links securely to the previous one, which helps in creating an unbreakable “chain.”

Wondering what is the difference between blockchain and other systems? Let’s find out.

In traditional financial systems, the power to verify transactions is with the bank. With blockchain, verification happens automatically in the network. Every participant has access to the same information, which increases the level of transparency and reduces the risk of fraud.

What this means for the finance industry:

According to research, over 81% of global financial institutions are exploring or actively deploying blockchain solutions. This is a clear sign that this technology is going to be adopted further.

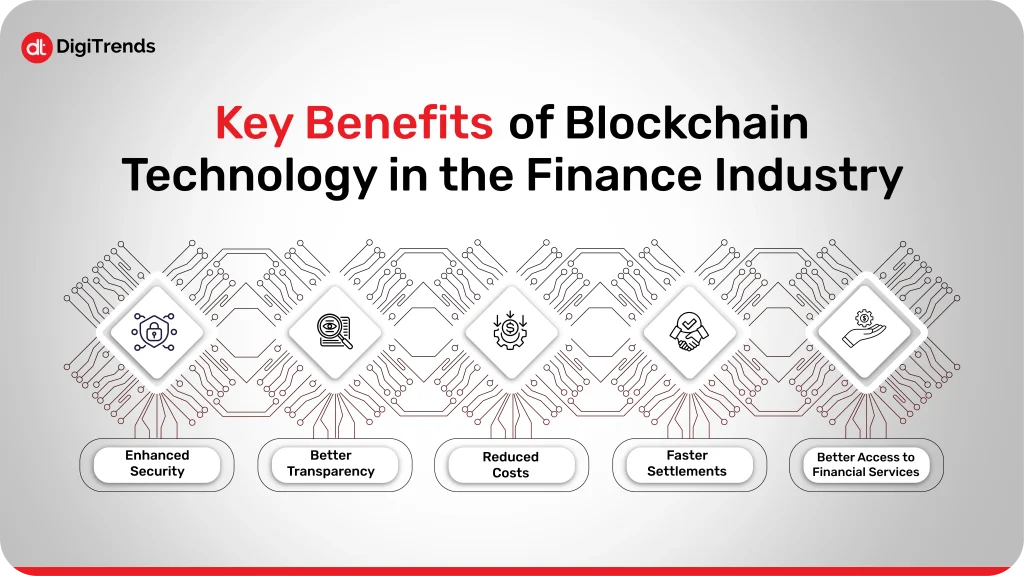

Blockchain technology doesn’t only help with cutting costs or making transactions faster, but it also helps in making a financial system that is more secure, transparent, and inclusive. Let’s have a look at all the key benefits of blockchain technology in the finance industry:

Traditional systems rely on central databases that can be hacked or manipulated. Whereas a blockchain system is decentralized, which makes such attacks far less likely. Every transaction in this system is encrypted and linked to the previous one, and all participants are supposed to agree on the validity of a transaction before it’s recorded.

This brings greater protection against fraud and cyberattacks for financial institutions and banks.

One of the biggest issues in finance is the lack of transparency. When the transaction process is not transparent, tracing errors or fraud gets difficult, but blockchain can easily change that.

Because in blockchain every transaction is present on the shared ledger, anyone involved in the process can verify its authenticity. This helps in increasing the level of trust among financial partners and improves compliance, especially for audits and regulatory checks.

There are intermediaries that verify the transactions like clearing houses, payment processors, and settlement agencies, and this increases the cost of financial transactions. With blockchain, these middlemen become less necessary. One-to- onetransactions can be completed directly, which helps in decreasing processing and administrative fees.

Settlement delays have also been a pain point in the finance industry.

But with blockchain, settlement can occur in real time with the help of smart contracts and self-executing agreements coded on the blockchain. These automatically trigger when certain conditions are met.

This is especially useful in stock trading, where settlement cycles that usually take two days (T+2) could potentially happen instantly.

Blockchain enables financial inclusion by reducing the need for traditional banking infrastructure. People without access to banks can still make transactions, get loans, or send money using blockchain-based platforms.

This is particularly impactful in developing economies, where nearly 17% adults remain unbanked (World Bank).

Now that you are aware of the key benefits of blockchain technology in finance, let’s have a look at the parts where it’s making a real impact:

When it comes to international money transfers, they are expensive and slow. But with the help of blockchain, we can eliminate intermediaries and enable instant, low-cost settlements.

Example: Ripple’s blockchain network allows banks and payment providers to send money globally in seconds. Major institutions like Santander and American Express use RippleNet and XRP for cross-border transactions.

Trade finance involves complex documentation and multiple parties, including banks, suppliers, and logistics providers. With the help of blockchain, we can streamline the process by storing all records on a shared digital ledger, which is accessible in real-time.

Through blockchain, real-world assets like real estate, stocks, and bonds can be easily digitized into tokens. These tokens can be traded securely, making investment more accessible to a wider audience.

Tokenization of these assets helps in increasing the liquidity and enables fractional ownership. This means that investors can easily buy small portions of high-value assets.

Lending and credit scoring have to be transparent but also secure, and blockchain offers exactly that. Blockchain-based platforms can assess creditworthiness using transparent and tamper-proof data. The smart contracts help in automating loan approvals, reducing paperwork and bias.

Example: DeFi (Decentralized Finance) platforms like Aave and Compound allow users to lend and borrow crypto assets directly without traditional banks.

Blockchain allows record-keeping that can’t be changed, which helps in simplifying compliance with financial regulations. Every transaction in blockchain is timestamped and verifiable, which helps regulators audit data in real time.

This level of transparency makes it easier for institutions to adhere to anti-money-laundering (AML) and know-your-customer (KYC) standards.

As mentioned before, transparency is a crucial part of the finance industry. Whether it’s tracking fund flows, ensuring accurate reporting, or preventing internal fraud, what most institutions struggle with is visibility. But blockchain can solve this issue by providing a single, shared source of data and truth.

This is possible because every transaction on a blockchain is permanently recorded and publicly verifiable (depending on the network type). This makes it nearly impossible to alter data without detection.

For example:

Instantly recording is enabled, which makes audits easier.

Regulatory reporting becomes automatic, which helps in reducing compliance costs.

Investors gain confidence since they can see where their funds go.

This is proof that blockchain in finance can help increase transparency by making financial data traceable, reliable, and accessible, all while maintaining privacy through encryption.

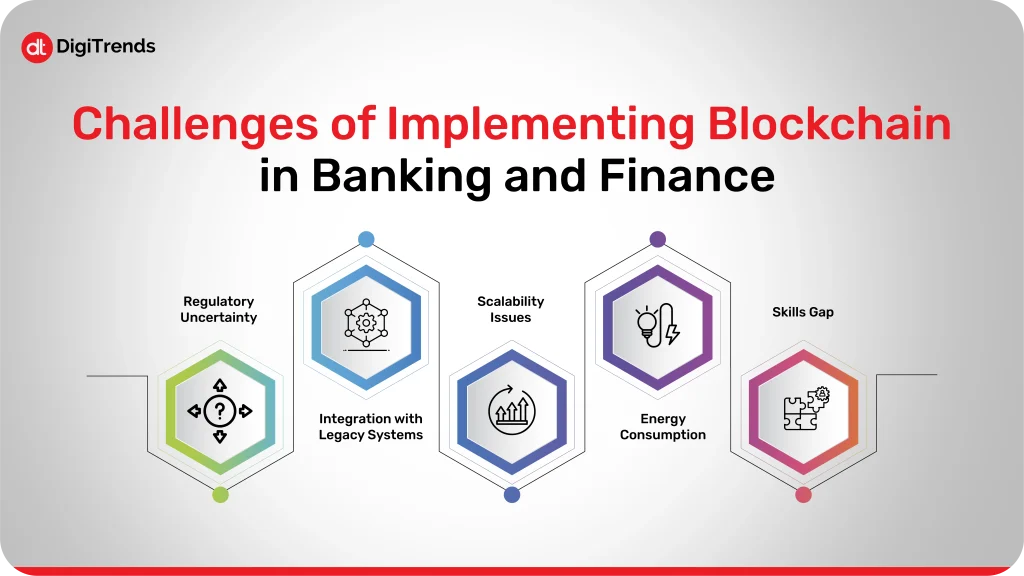

Blockchain has a lot of potential in the finance industry. But there are some challenges as well. Let’s have a look at the challenges of implementing blockchain in the finance industry.

Different countries have different regulatory rules for the finance industry, particularly blockchain and cryptocurrencies, which shows that there is gap in global regulation that makes it difficult for financial institutions to fully comply with all the rules and regulations.

Banks are required to operate under strict compliance laws, and if they wish to integrate blockchain in their systems then they might have to go through unclear legal frameworks.

The systems banks usually use are outdated and not designed for blockchain technology; therefore, integrating a decentralized ledger into these old systems can be complex and expensive.

As the transactions increase, there is a chance that the blockchain network will slow down. For example, Bitcoin can handle between 3 to 7 transactions per second, compared to Visa’s 65,000+ approximately.

This means that financial institutions need faster and more scalable blockchain networks before mass adoption becomes practical.

There are sustainability concerns in adding blockchain technology because they need high energy to work. Although new models are more energy-efficient but not all systems have been changed yet.

Blockchain technology requires specialized skills in cryptography, distributed computing, and smart contract development, and the challenge is that the demand for people who are skilled in blockchain is more than the supply, which can slow down the implementation.

The benefits and implementation of blockchain in finance tell us that the future of blockchain is indeed promising. As technology changes with time, the regulations will also change according to it, so we can expect to see the wide adoption of blockchain in financial institutions.

Predicted Trends:

According to research, the global blockchain market in finance is expected to reach USD 79.3 billion by 2032. That growth will be driven by banks, fintechs, and governments seeking faster, safer, and more transparent systems.

At DigiTrends, we can help businesses in the financial sector build blockchain-powered solutions that drive efficiency, trust, and compliance. Our expert developers specialize in blockchain in banking and finance, focusing on:

DigiTrends can help clients transition smoothly from legacy systems to next-gen financial infrastructure.