Trusted by 500+ companies

OUR SERVICES & SOLUTIONS

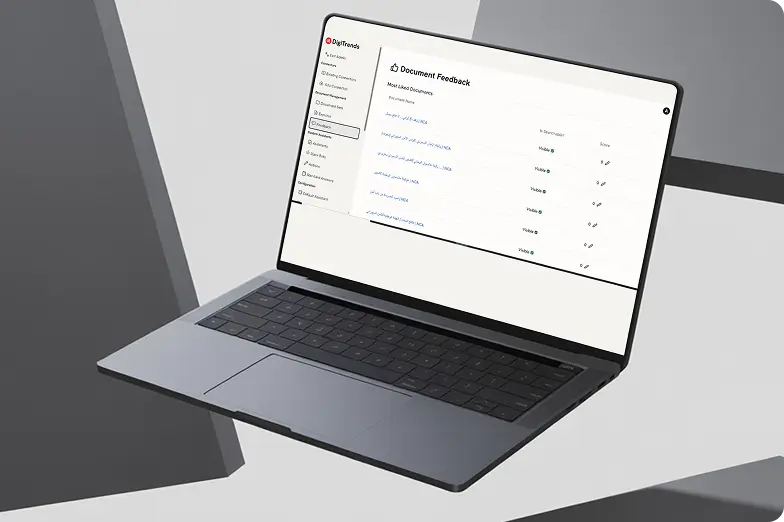

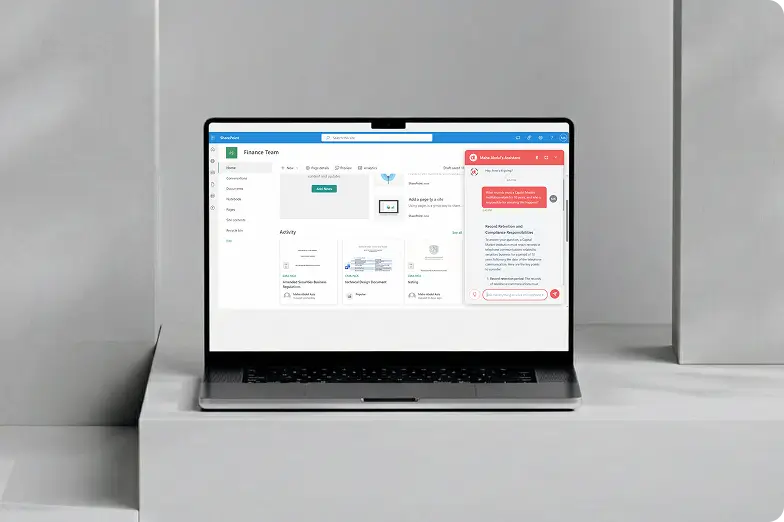

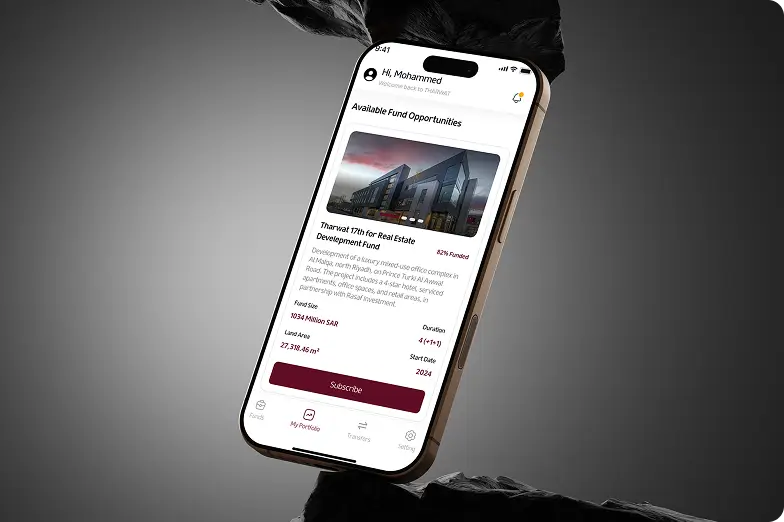

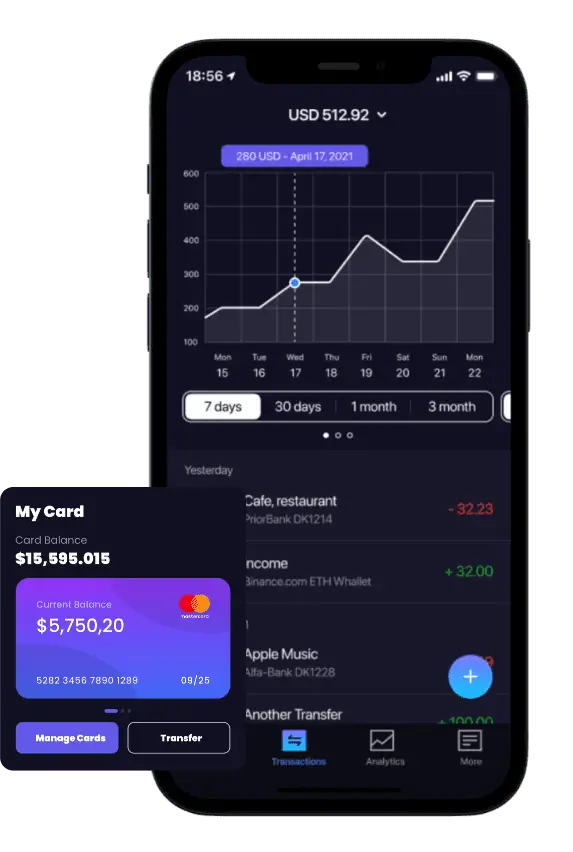

Tailored Solutions For Your Financial Needs With Custom Fintech Software Development Services

At DigiTrends, we understand that mutual fund companies need custom fintech solutions to navigate the constantly evolving financial landscape. That's why we offer a wide range of Fintech software applications and professional services that are tailored to meet the unique needs of each client. Our teams of experts work closely with clients to identify areas of improvement and develop customized solutions that drive growth, reduce costs, and improve efficiency.

Our Process

Fintech Product Development Strategy

At DigiTrends, we believe in a collaborative approach to fintech software development that puts your business needs and goals first. Our process is designed to ensure that every step is carefully planned and executed to deliver a high-quality and reliable solution

01

Discovery Phase

In the Discovery Phase, we set the foundation for your Fintech masterpiece. Our experts immerse themselves in your vision, studying market trends, user behaviors, and emerging technologies. We unearth insights that fuel creative ideas and reveal untapped opportunities. Through rigorous research and analysis, we define the strategic direction that will guide your product's evolution.

02

Front-end Development And Design:

Our front-end developers ensure that website users can engage with the page without difficulty. They accomplish this by combining coding, architecture, and technology to code a website's aesthetic and take care of debugging; therefore, our web designers thoroughly assess the target audience to comprehend their needs and incorporate these insights into UI design.

03

Back-end Development:

Our back-end developers ensure the website functions appropriately by concentrating on databases, back-end logic, application programming interfaces (APIs), infrastructure, and servers. They employ programming that facilitates database communication, data storage, comprehension, and deletion for browsers.

04

App Integration:

Integrating an app allows seamless data synchronization between platforms; therefore, to interface your web application with a company or external systems and services, we set up APIs and provide our clients with an exquisite experience.

05

QA Testing

We run QA tests to check for bugs and problems with the website's functionality, security, interoperability, translation problems, etc.

Key Features

Unlock The Power Of Fintech Innovation!

Being the top Fintech Software Development Company, we take pride in being a leading provider of cutting-edge Fintech Software Development Services. Our team of skilled developers and financial experts are committed to revolutionizing the financial landscape by harnessing the potential of technology. Are you ready to embark on a journey of fintech innovation? Let DigiTrends be your trusted partner in transforming the financial landscape and empowering your business for success because we offer:

Tailored Solutions

At DigiTrends, we believe that every business is unique, and one-size-fits-all solutions don't cut it in the fast-paced world of fintech. That's why our team of experts takes the time to understand your specific needs and objectives. We collaborate closely with you to gain insights into your business processes, challenges, and goals.

Continuous Support

Our dedication to your success doesn't end with the delivery of the software. We understand that the fintech industry is dynamic, and as your business evolves, you may need updates, maintenance, and support. That's why we provide ongoing support and maintenance services to ensure that your fintech software performs optimally at all times.

Quality Assurance

We are committed to delivering high-quality and error-free software solutions to our clients. Our robust quality assurance processes involve rigorous testing, meticulous code reviews, and stringent quality checks at every stage of development. This ensures that the end product meets the highest standards of performance, security, and reliability.

Competitive Advantage

In the fiercely competitive fintech landscape, gaining a competitive edge is paramount for success. With our innovative fintech solutions, you can stay ahead of the curve and outshine your competitors. We leverage the latest technologies and industry best practices to create forward-thinking solutions that drive efficiency, enhance user experience, and empower your business to reach new heights.

WHY CHOOSE US

Stay Ahead With DigiTrends Fintech Application Development Services

In today's fast-paced digital world, financial institutions must stay ahead

of the curve to meet their customers' evolving needs and expectations. Our Fintech software

applications are here to help you navigate this ever-changing landscape and unlock the full

potential of technology in the financial sector.

As a Fintech app development company,

we are committed to driving fintech innovation and empowering financial institutions to stay

competitive in the digital era. Our customer-centric approach, combined with cutting-edge

technology, ensures that you are equipped to meet the ever-changing demands of your

clients.

Join us on this transformative journey and witness the power of fintech

applications revolutionizing the financial industry. Contact our team today, and let's co-create

the future of finance together!

Our Events

DigiTrends at the Forefront of Global Innovation & Collaboration

At DigiTrends, we actively engage in global events and connect with global leaders to discuss digital transformation, strategic collaboration, and understand how to reshape industry experiences through smart and scalable solutions. Whether we’re showcasing groundbreaking work, exchanging ideas, or exploring the latest solutions, our team is committed to staying connected with global leaders and trends that shape the future.

Digital Foreign Direct Investment Forum - 2025

Participated in the DFDI Forum 2025, hosted by the Government of Pakistan from April 29 till 30 in Islamabad, Pakistan.

Expomed Eurasia Exhibition - 2025

Formalized a Strategic Partnership with RSS Savunma Sanayi ve Teknoloji at the Expomed Eurasia Exhibition 2025 in Istanbul, Turkey

LEAP - 2025

Signed a strategic agreement to become the digital transformation partner of Seen Tarbi for FinTech

Arab Health Exhibition - 2025

Partnered with Melatronica Spa for Cybele Smart Unveiling on VR at Arab Health Exhibition 2025

DUPHAT - 2025

Our Creative Director, Farah Zahid, represented DigiTrends at DUPHAT 2025, held from January 7-9 at the Dubai World Trade Centre. She engaged with industry professionals, highlighted our pharma-tech innovations, and showcased interactive solutions that reflected our contributions to digital transformation in the pharmaceutical sector.

TechCrunch Disrupt - 2024

Our CEO, Mr. Samad Saleem, actively engaged with innovators driving digital transformation at the TechCrunch Disrupt, from October 28 to 30, 2024 in San Francisco.

Pakistan Tech Summit - 2024

Our CEO, Mr. Samad Saleem, served as a keynote speaker and panelist at the Tech Summit in Dubai, 2024 where he shared expert insights on the evolving digital landscape.

24' Fintech

Our Regional Head KSA, Zeeshan Rehman, and Sales & Marketing Manager, Nimra Chauhan, represented DigiTrends at 24 Fintech, leading insightful conversations, engaging in valuable industry networking, and driving meaningful exchanges that highlighted our commitment to innovation in the fintech industry.

Finnovex Summit - 2024

Our CEO, Samad Saleem, and KSA Region Head, Zeeshan Rehman, represented DigiTrends at Finnovex Summit 2024, held in Saudi Arabia, the region’s leading fintech event.

Abu Dhabi Global Healthcare Week - 2024

DigiTrends joined the Abu Dhabi Global Healthcare Week from May 13–15, 2024, an influential platform that brings together global healthcare leaders, innovators, and policymakers to shape the future of healthcare on a global scale.

Norway Health Tech Festival - 2024

CEO of DigiTrends Norway, Raja Khuram Iqbal, and CMO of DigiTrends Norway, Henry Shek, represented us at the Norway Health Tech Festival 2024, where they engaged with industry leaders, explored emerging trends, and highlighted our contributions to the future of healthcare technology.

Finnovex Summit - 2024

Our CEO, Samad Saleem, and KSA Region Head, Zeeshan Rehman, represented DigiTrends at Finnovex Summit 2024, held in Saudi Arabia, the region’s leading fintech event.

DUPHAT - 2024

Team DigiTrends attended DUPHAT UAE from January 9 to 11, 2024, at the Dubai World Trade Center, sharing insights about our contributions to the Pharma industry.

GIANT Health Event - 2025

DigiTrends was represented at the UK’s leading healthcare technology gathering, the GIANT Health Event, by our CEO, Samad Saleem, Board of Directors, Dr. Zakiuddin Ahmed, and CFO, Mahwash Samad

Seamless Saudi 2025

Our CEO, Samad Saleem, Chief Technology Officer, Talha Ahmed, and Sales and Marketing Manager, Nimra Chauhan, attended the Seamless Saudi Arabia event at Riyadh, where they had the opportunity to explore emerging trends and network with industry leaders.

Global Health Exhibition - 2025

Our Board of Director, Dr. Zakiuddin Ahmed, and Business Development Manager, Sidra Iqbal, attended the Global Health Exhibition, where Dr. Zaki shared his expertise and insights on emerging trends and innovations in healthcare.

Money20/20 Middle East

Our team at DigiTrends, led by CEO Samad Saleem, Board Member Shaikh Ayaz Ali, COO Retired Air Commodore Tasaddaq Banoori, and Regional Head (KSA) Zeeshan Rehman, attended Money 20/20 Middle East, a financial innovation conference where they explored the future of fintech to engage with industry leaders.

Riyadh Healthcare Leaders Forum

Our Board Member, Shaikh Ayaz, and Business Development Manager, Sidra Iqbal, represented DigiTrends as co-organizers of the Riyadh Healthcare Leaders Forum in the presence of Federal Health Minister Mustafa Kamal, an event that brought together over 50 distinguished Pakistani doctors and healthcare professionals to discuss advancements in digital health, and AI integration in modern healthcare.

127th Anniversary of the Declaration of Independence of the Republic of the Philippines and the 76th Anniversary of Philippines–Pakistan Bilateral Relations.

Our CEO, Samad Saleem, and COO, Mahwash Samad, were honored to attend the 127th Anniversary of the Declaration of Independence of the Republic of the Philippines and the 76th Anniversary of Philippines–Pakistan bilateral relations. The event was graciously hosted in the presence of His Excellency Dr. Emmanuel R. Fernandez, Ambassador of the Philippines to Pakistan, along with his spouse, Mme. Alicia Kalaw-Fernandez.

Networking Event in Riyadh

Our Board Member, Shaikh Ayaz, and COO, Retired Air Commodore Tasaddaq Banoori, were invited to a productive networking dinner in Saudi Arabia by Pakistan’s Ambassador to Saudi Arabia, H.E. Ahmad Farooq, that brought together leading Saudi IT executives and Pakistani technology leaders.

AWARDS & RECOGNITION

We’ve been recognized by top industry platforms for our innovation and excellence across digital solutions. These awards reflect our commitment to quality, creativity, and delivering impactful results for our clients.

Check ReviewsWhat Our Clients Say About DigiTrends

Explore authentic testimonials from our content clients, gaining valuable insights into their collaborations with DigiTrends. Dive into your app transformation possibilities, finding inspiration in our success stories.

FREQUENTLY ASKED QUESTIONS

Everything You Need To Know About Fintech Software Development

Check out answers to the frequently asked question about DigiTrends Fintech Software Development to determine if we can be of any service to you.