About the Project

About Tharwat

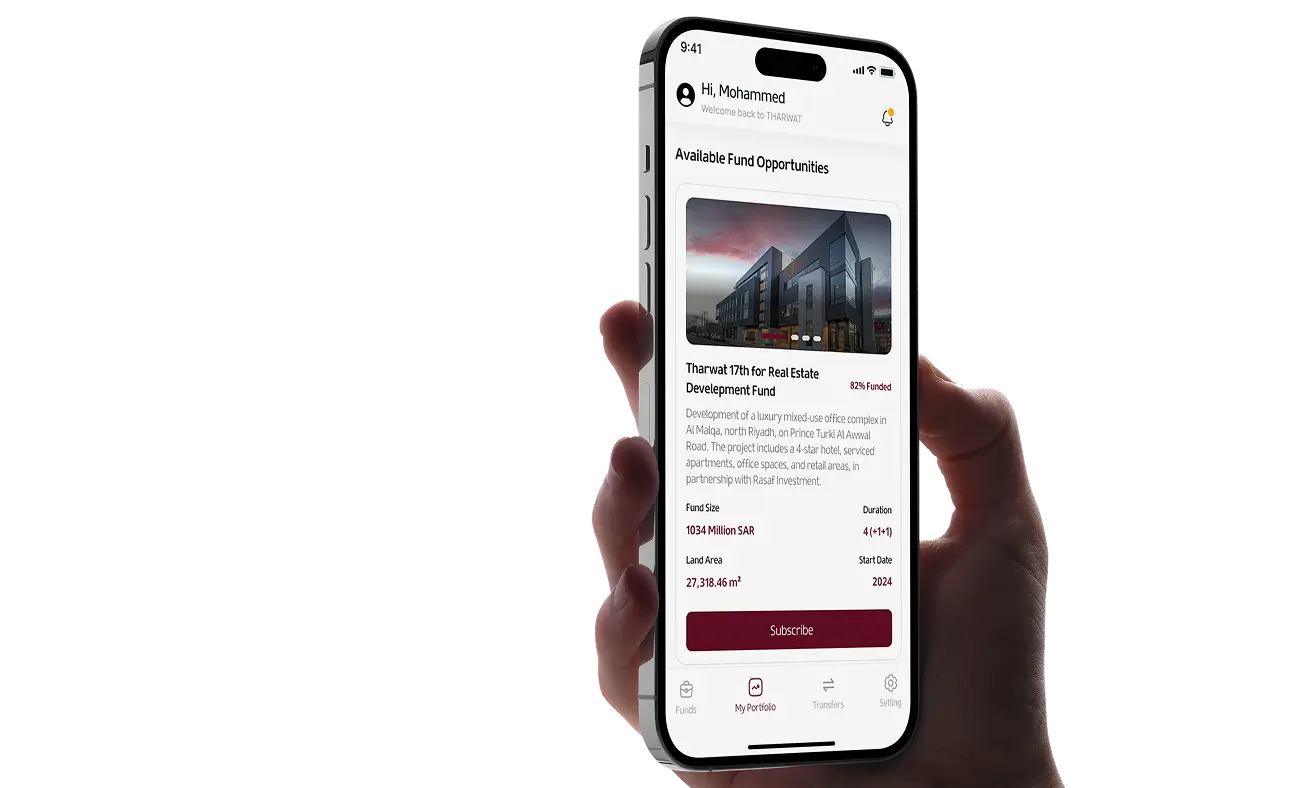

Tharwat Financial Securities aimed for an automated system that could change how investors onboard, manage portfolios, and engage with investment opportunities. Their existing processes relied heavily on manual workflows and disconnected systems, leading to delays, operational inefficiencies. DigiTrends designed and delivered an all-in-one digital investment platform that unified onboarding, portfolio management, secure transactions, and client communication into a single, compliant ecosystem.

At DigiTrends, we provide financial platform development services with secure architectures and user-centric design. Our financial solutions make transactions smoother and deliver measurable results aligned with the specific goals of the organization.

The Vision & Objectives

What We Set Out To Achieve

Streamline Investor Onboarding

To eliminate delays and errors in the investor onboarding process to enhance customer satisfaction, and provide them with a smooth onboarding.

Centralize Investment Management

To replace multiple disconnected platforms with a smart unified platform for portfolio tracking and transactions to cut the extra effort.

Ensuring Security and Regulatory Compliance

To create a financial platform that can protect sensitive investor data while also meeting local and international financial regulations.

The Core Challenges

The Problems We Needed To Solve

-

Inefficient Manual Onboarding

Tharwat’s clients were dissatisfied with the manual and long Know Your Customer process and the delayed onboarding process of the platform.

-

Fragmented Investor Experience

Multiple platforms had to be used by the clients to track portfolios, view transactions, and access opportunities, which was time-consuming.

-

Security and Compliance Risks

Increasing digital transactions raised concerns around data security, authentication, and regulatory adherence.

Overcome Business Challenges With FinTech Solutions

We are experienced in helping businesses build secure financial platforms that help enhance user experience through smoother processes while being fully compliant.

The Solution

How We Addressed The Problems

To address these challenges, DigiTrends developed a custom financial system that transformed investor engagement and allowed the firm to scale within a regulated financial environment.

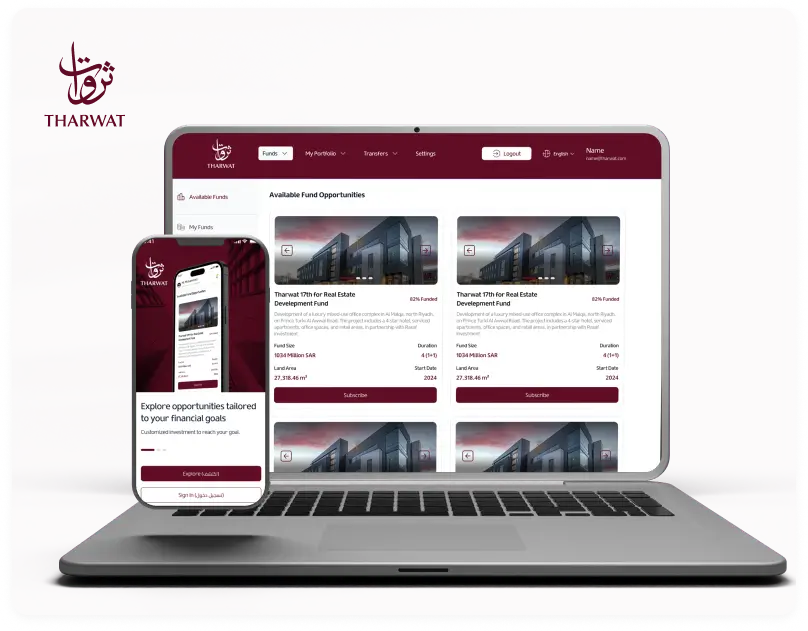

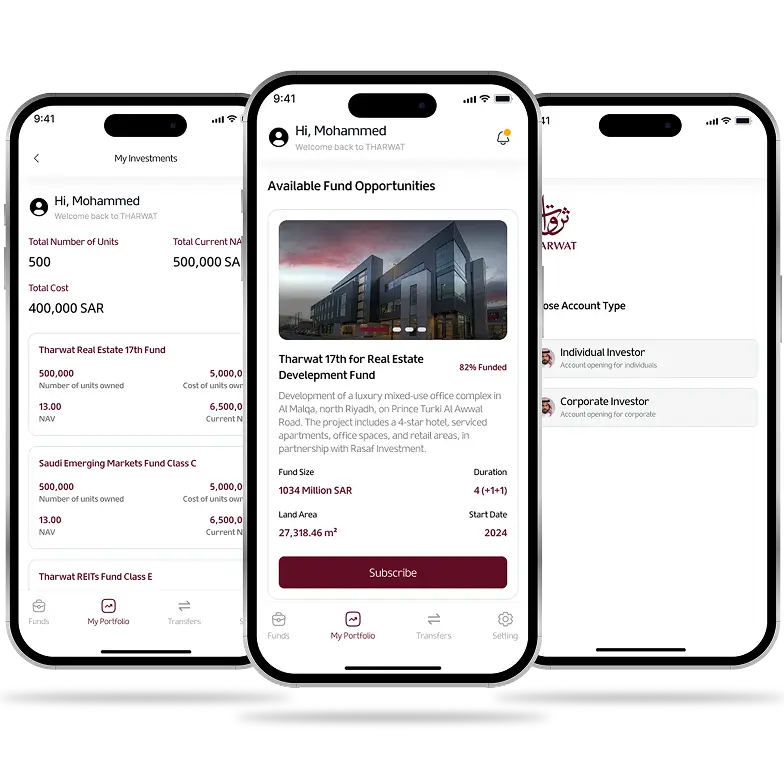

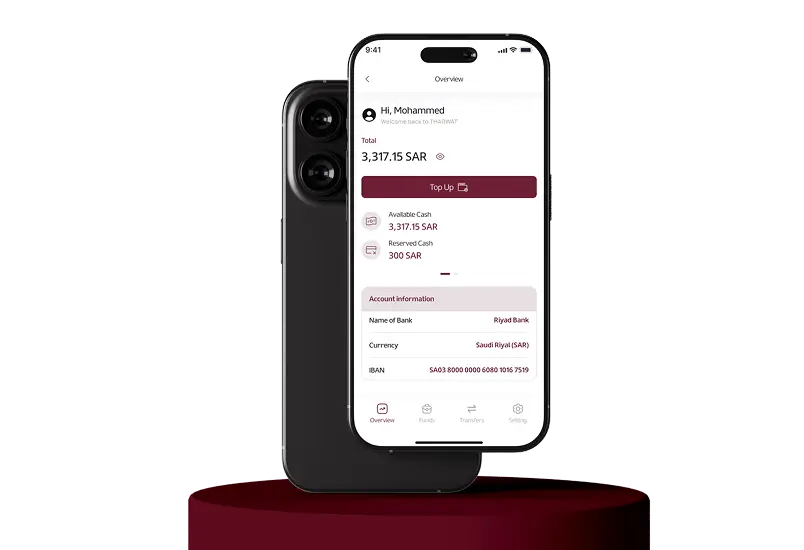

Unified and Investor-Centric Digital Platform

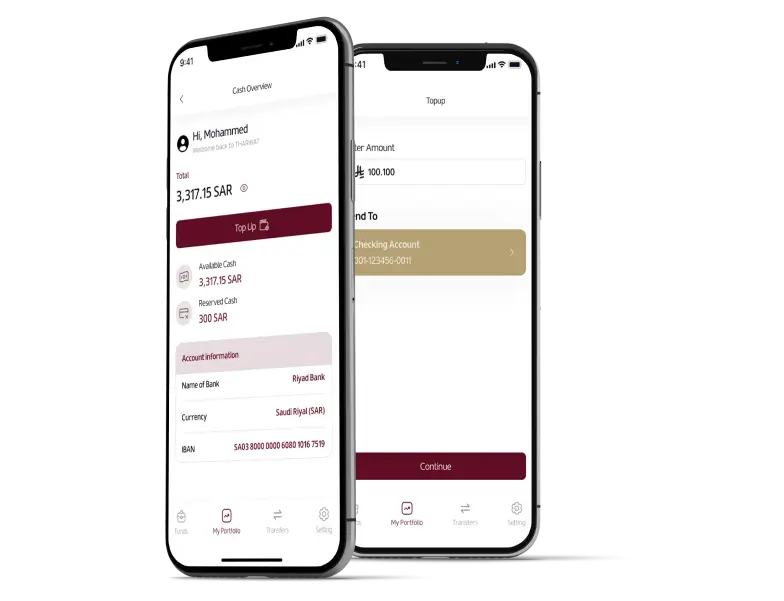

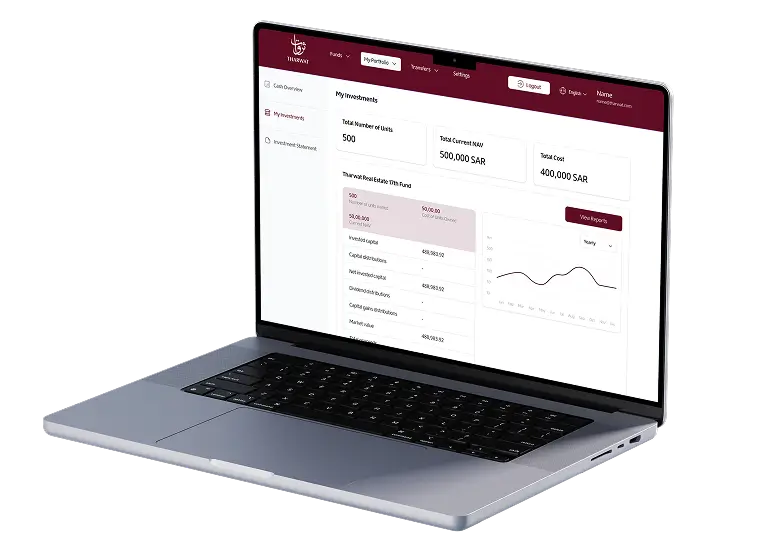

Delivered a secure web and mobile platform that centralized onboarding, portfolio management, transactions, and investor communication into a single experience.

Automated Onboarding with Real-Time Visibility

Integrated Al-Elm and Nafath to automate KYC and identity verification while giving investors real-time access to portfolios, transactions, and opportunities.

Secure, Compliance-Ready Architecture

Implemented multi-layer authentication, role-based access control, end-to-end encryption, and built-in regulatory compliance to ensure data security and adherence to financial regulations.

Project Impact

What Success Looked Like

-

Seamless Onboarding

The onboarding process became shorter and easier for new clients with the help of an automated identity verification system.

-

Higher Investor Engagement

The platform engagement increased with the help of features like real-time portfolio tracking, insights, and easy access to opportunities.

-

Stronger Security and Compliance

The platform became fully compliant with financial regulations with the help of multi-layer authentication, encryption, and built-in regulatory controls.

-

Improved Operational Efficiency

The automation of manual tasks reduced the extra effort, lowered support dependency, and streamlined internal investment operations.

DigiTrends centralized investment management into a single digital ecosystem for Tharwat Financial Securities, which helped them transform investor engagement, improve operational efficiency, and scale securely within a regulated financial environment.

Tech Stack

Built on a World-Class Tech Stack

Vue.js

An adaptable framework that helps create web user interfaces.

NodeJs

Enables smooth running for server-side applications.

.NET

Builds secure and scalable applications for web, desktop, and enterprise systems.

Enhanced Investor Experiences.

Tharwat Financial Securities partnered with DigiTrends to modernize how investors onboard, manage portfolios, and engage with investment opportunities.

Turn complex investment management into a secure digital journey.

More Case Studies

Exceptional Results Delivered Across Platforms

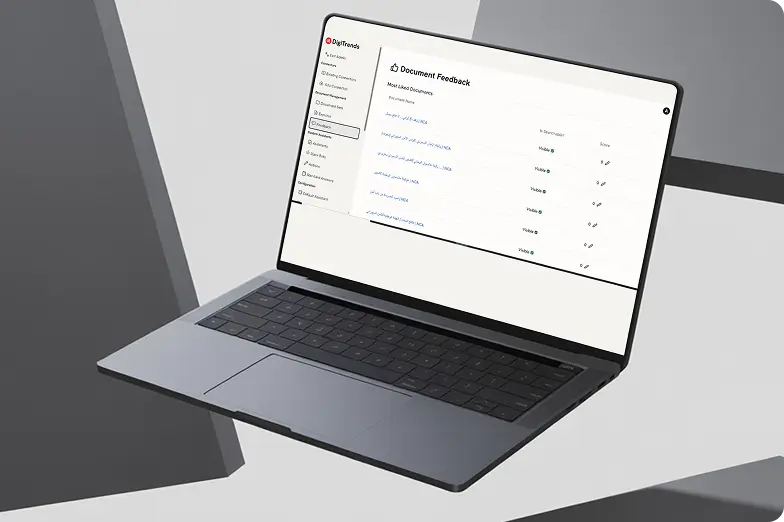

Offline Repository with Built-in AI Assistance

DigiTrends recognized that financial institutions were finding governance and regulatory compliance challenging and created an AI compliance agent to make compliance easier.

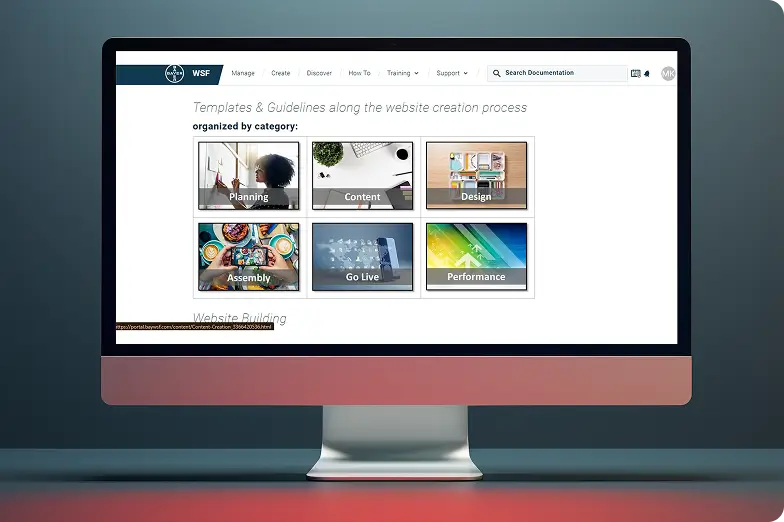

A Digital HCP Engagement Platform

DigiTrends partnered with Novartis to develop an HCP portal for non-promotional medical content and supports healthcare professionals worldwide.

A Conference Mobile App for HCPs

DigiTrends partnered with Roche to develop a mobile application that could support the medical conferences through a single platform with easy access to all information.

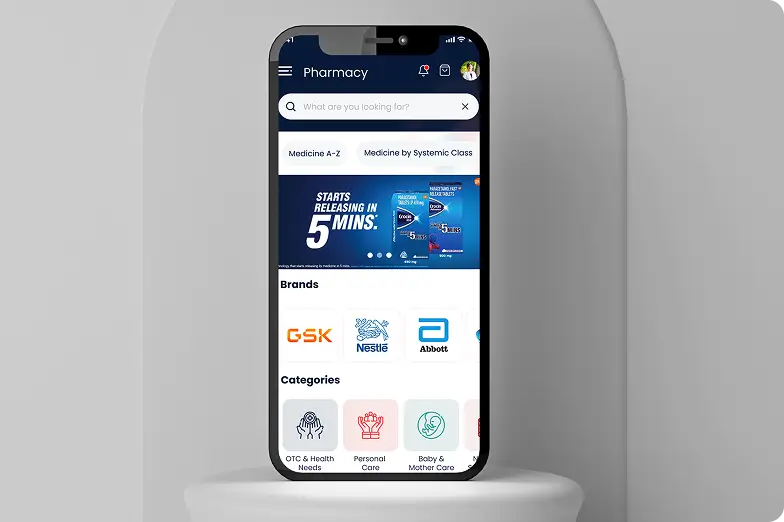

A Drug Marketplace with Drug Information

DigiTrends partnered with an organziation to create DigiPill, a drug marketplace that provided patients with better access to drug information and medical convenience.

Brands We Have Worked With

Our Clients

DigiTrends has partnered with over 600 brands, including several Fortune 500 companies, to digitally transform core operations through innovative and scalable solutions. Trusted by our clients for consistent excellence, we take pride in delivering impactful digital experiences

What Our Clients Have to Say

Client Reviews

Have a project in mind?

let’s talk

Whether you’re looking to innovate, scale, or transform, our team is here to help. Connect with us to discuss your goals, explore tailored digital solutions, and drive meaningful growth for your business.

Our Offices

USA Headquarter

USA (Corporate Office)

Dubai,UAE

KSA

Norway Office